Medical technologies

Medical technologies, or MedTech, aims to enhance the quality of healthcare while reducing medical and hospital costs, mainly through technological progress.

Why invest in medical technologies?

In response to a growing and ageing population, the healthcare sector must adjust to a larger number of patients and their needs, some of which are new. Medical technologies are subject to constant innovation and can enhance the quality of healthcare and provide assistance at all levels.

Faster, simpler and more efficient treatments also address the imperative to lower medical costs for everyone – governments, professionals and patients.

The MedTech market is growing fast and is expected to reach 595 billion dollars in revenues by 2024. This forecast of 5.6%-plus growth over six years reflects demand that has been rising constantly in the sector, driven mainly by the development of preventive medicine and patient autonomy, thanks to new technologies.

With the technological environment in full flux, sector leaders have shown a recurring appetite for financial deals, with, on average, between 230 and 270 mergers and acquisitions annually.

Combining technology with medicine to meet the economic challenges of healthcare

A broad, multi-component universe

Our approach

While they all share a common purpose, MedTech companies are diverse and varied. Some develop ambitious technologies, such as surgical robots, while others come up with simpler products, such as bracelets to measure blood pressure.

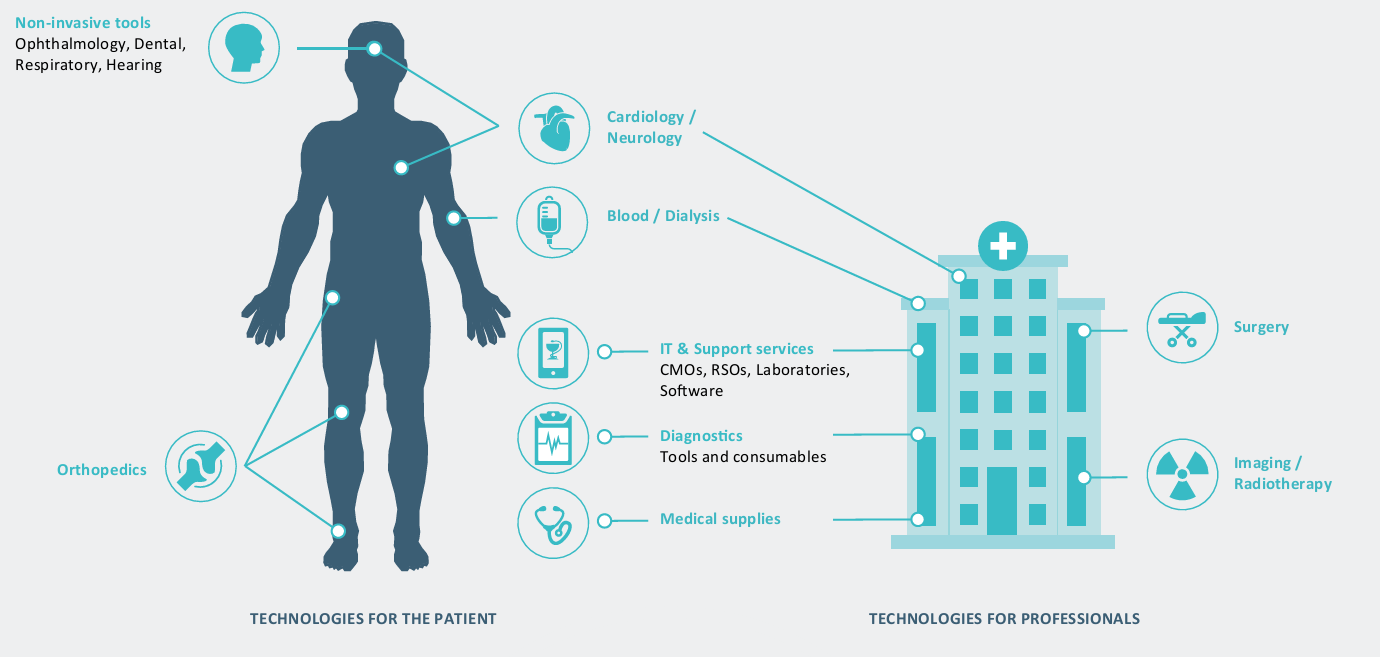

They offer single- or multiple-use solutions and tools used by various parties on a daily basis:

- By healthcare professionals: imaging tools (scanners, MRI, etc.), automated machines (laser surgery, etc.), software for improved treatment of patient medical records, etc.

- By patients: protheses, mobile apps, disposable contact lenses, implants, etc.

We have identified several segments that can be classified into five broad stages – prevention, diagnosis, intervention, treatment and follow-up care.

Consisting of about 220 companies, the investment universe encompasses the entire medical technology ecosystem throughout the healthcare path. It aims to address issues involving patients, medical professionals and hospitals.

Companies that are subject to serious controversies are excluded from the investment universe, as well as those with the poorest ESG practices overall or based on criteria deemed fundamental to the thematic.

The main risks incurred by this strategy are the risk of loss of capital, equity risk, interest-rate risk, credit risk, and exchange rate risk. To find out more about the fund’s risk profile, please refer to its legal documentation.