Sustainable urbanisation

Sustainable urbanisation is a global thematic and one of the greatest challenges of our century. Many investment opportunities are identifiable among the companies that put forth solutions for making tomorrow’s cities larger, smarter and more sustainable.

Why invest in sustainable urbanisation?

The United Nations has earmarked sustainable urbanisation as a Sustainable Development Goal (SDG).

The 21st century will clearly be the century of cities, which are accounting for an ever-growing portion of global activity and population. Powerful demographic and economic forces are driving the thematic’s growth potential, particularly in emerging economies, they are also facing environmental, social and economic challenges.

Sustainable development will leave its footprint on urbanisation and will inspire solutions for managing population flows, meeting needs, and improving urban living standards, while helping to shrink cities’ environmental impact.

The transition to the city of tomorrow is the source of many opportunities: from urban infrastructures, which are the cornerstones of economic development and the energy transition, to technological innovations for efficient and sustainable management of cities, to the invention of new services to facilitate city-dwellers lives on a daily basis.

A present to be lived, a future to build

A universe for grasping sustainable urbanisation holistically

Our approach

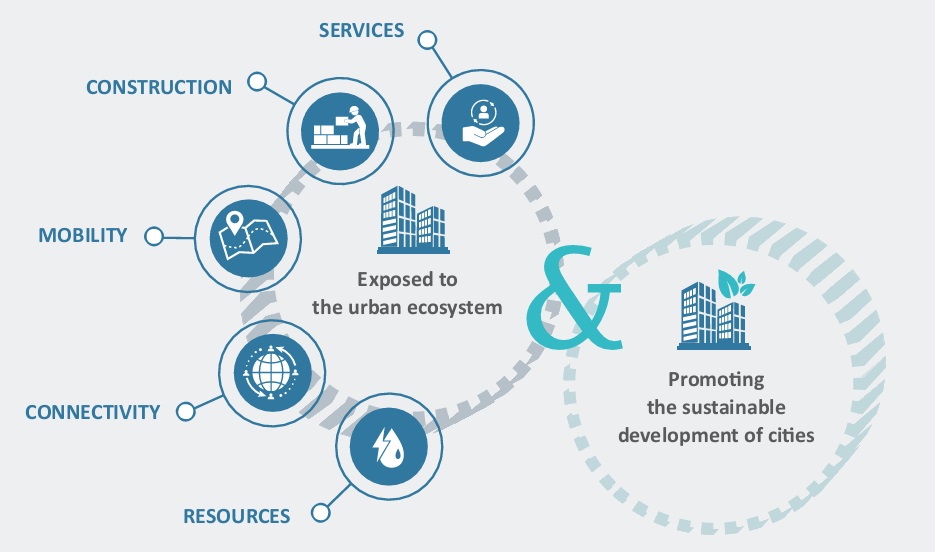

The investment universe is designed to cover the entire ecosystem that cities depend on to function. The sector breakdown is based on the management team’s identification of five pillars of the urban ecosystem: Construction, Mobility, Connectivity, Resources and Services.

Consisting of about 500 companies, the investment universe encompasses all countries and features a wide range of sectors covering all growth drivers of the thematic.

In order to exclude companies deemed incompatible with sustainable and harmonious urban development, we rely on overall ESG ratings and ratings based on thematic-specific criteria, as well as data on controversies.

The main risks incurred by this strategy are the risk of loss of capital, equity risk, interest-rate risk, credit risk, and exchange rate risk. To find out more about the fund’s risk profile, please refer to its legal documentation.