Global food challenge

Why invest in the global food challenge?

Global population growth, urbanisation and increased incomes have a dual impact on food demand –quantitatively through increased consumption and qualitatively in dietary shifts.

By 2050, the agro-food industry will have to feed more than 9 billion people, people, moreover, whose living standards will be generally higher and who will aspire to eat more and better.

Feeding a growing global population just as resources are becoming scarcer and the climate environment is uncertain is a sizeable challenge, in that it requires making food more available while preventing and reversing the depletion of resources. Meeting these challenges will require optimised use of these resources, along with efficient management of waste.

Heavier demand is being driven by dietary trends. Middle classes in developing countries want to mitigate malnutrition and diversify their diets. Consumers worldwide are seeking convenience but without giving up quality and nutrition.

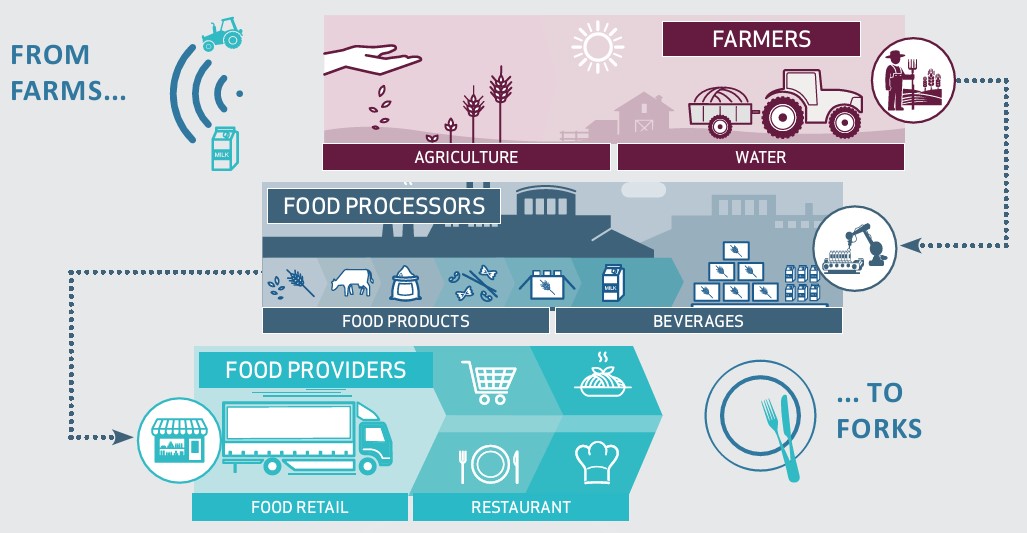

A sustainable approach from farm-to-forks

Investing throughout the food value chain

Our approach

We invest in equities and, hence, not directly in commodities.

This multi-sector coverage allows us to expose our investments to structural trends that affect the food industries.

Our sustainable approach durable, based on overall ESG ratings as well as ratings based on specific criteria and data on controversies, is supplemented by impact measures in order to minimise our water and carbon intensities and to maintain a high rate of waste recycling.

To tap into the thematic’s entire growth potential, we invest in all agro-food industries and classify them into six sub-themes.

The investment universe of about 600 companies runs the gamut of the global food value chain, encompassing agriculture, water, food, beverages, food retailing and catering.

The main risks incurred by this strategy are the risk of loss of capital, equity risk, interest-rate risk, credit risk, and exchange rate risk. To find out more about the fund’s risk profile, please refer to its legal documentation.

Annual impact report

Discover our latest Food For Genetations impact report

With the aim of transparency and in order to make responsible investment ever more concrete, we publish an annual impact report.