The circular economy

Why invest in the circular economy?

Our current modes of production and consumption are based on a linear “extraction-manufacturing-consumption-disposal” model. This is exhausting our planet and its biodiversity. Such a model is not environmentally viable.

It is urgent to set up a more sustainable alternative model such as the circular economy, the principle of which is not only to reduce the number of resources used in the manufacturing processes but also the volume of waste and pollution generated, once the goods have been consumed.

Eco-design, extending product lifecycles, repair, recycling, etc. are all fundamentals of the circular economy and help enhance the use of resources and preserve the environment.

Worldwide adoption of the circular economy would reduce the use of raw materials by an estimated 28% and GHG emissions by 39% within the next decade. The circular economy is also a key factor in preserving biodiversity, as it can help address the underlying causes of the harm being done to it.

By reducing the use of resources, the circular approach may also be a solution for reducing dependence on imports of critical raw materials and help set up a resilient supply chain.

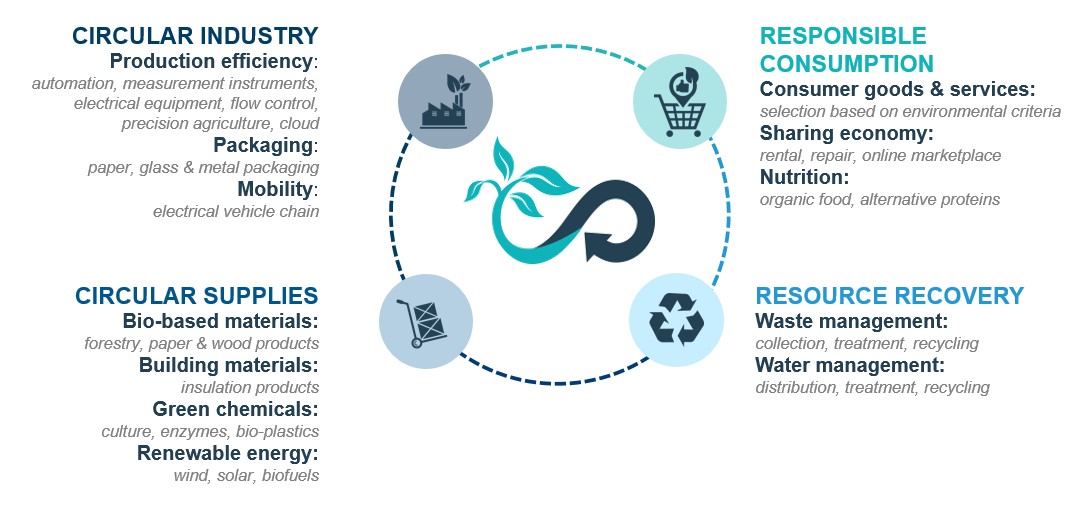

A universe reflecting a circular approach throughout a product’s lifecycle

Our approach

Governments and public institutions are increasingly aware of the benefits of the circular economy and are using regulatory tools to accelerate the transition.

Consumers are doing the same through their consumer choices.

To tap into this theme’s potential, the investment universe covers the entire ecosystem of the circular economy, consisting of companies that offer or adopt circular solutions at all stages of the product lifecycle.

With this in mind, the investment universe is based on four pillars:

- Renewable resources,

- Circular manufacturing,

- Responsible consumption,

- Resource recovery.

The strategy also includes a comprehensive sustainable approach consisting of applying filters and ESG controversies to the process of engagement and dialogue with some companies, and to monitor extra-financial metrics on carbon intensity and biodiversity footprint.

The main risks incurred by this strategy are the risk of loss of capital, equity risk, interest-rate risk, credit risk, and exchange rate risk. To find out more about the fund’s risk profile, please refer to its legal documentation.